What Is Incentive Management in Banking? Incentive management refers to the targeted allocation of monetary or points-based rewards to trigger desired customer behavior. In the banking sector—especially in the credit card business—it’s a proven method to: Increase card activation rates Promote regular usage Reactivate dormant users Win back customers at risk of cancellation With the

Account, loan, or mortgage – every process abandonment costs real money. Especially when the visitor came via paid traffic. With targeted exit-intent pop-ups, banks catch users before they leave – and turn them into qualified leads. Scenario: The lost lead Imagine this: A potential customer – let’s call him Thomas – is searching online for

The Future is Central: Why a Modern Data Platform is the Foundation for GDPR Compliance, Efficiency, and AI-Driven Growth Do your departments speak the same language when it comes to your most valuable asset – your data? Or are your CRM, ERP system, and marketing tools operating in silos, generating conflicting versions of the truth?

Generative AI is on everyone’s lips – and the pressure to deploy the technology productively is growing every day. Executives across Europe are facing the same question: How can we leverage the efficiency and potential of Gen AI without falling into the traps of GDPR, data protection, and uncontrollable risks? The concern is valid. Many

The Future is Central: Why a Modern Data Platform is the Foundation for GDPR Compliance, Efficiency, and AI-Driven Growth Do your departments speak the same language when it comes to your most valuable asset – your data? Or are your CRM, ERP system, and marketing tools operating in silos, generating conflicting versions of the truth?

Introduction: KYC – Mandatory but a Growth Blocker In the financial sector, KYC is a legal obligation. But in practice, it’s often a costly bottleneck. Manual review processes, system breaks, long wait times – especially in digital channels, every lost lead is money left on the table. Customers today expect instant onboarding. The reality: KYC

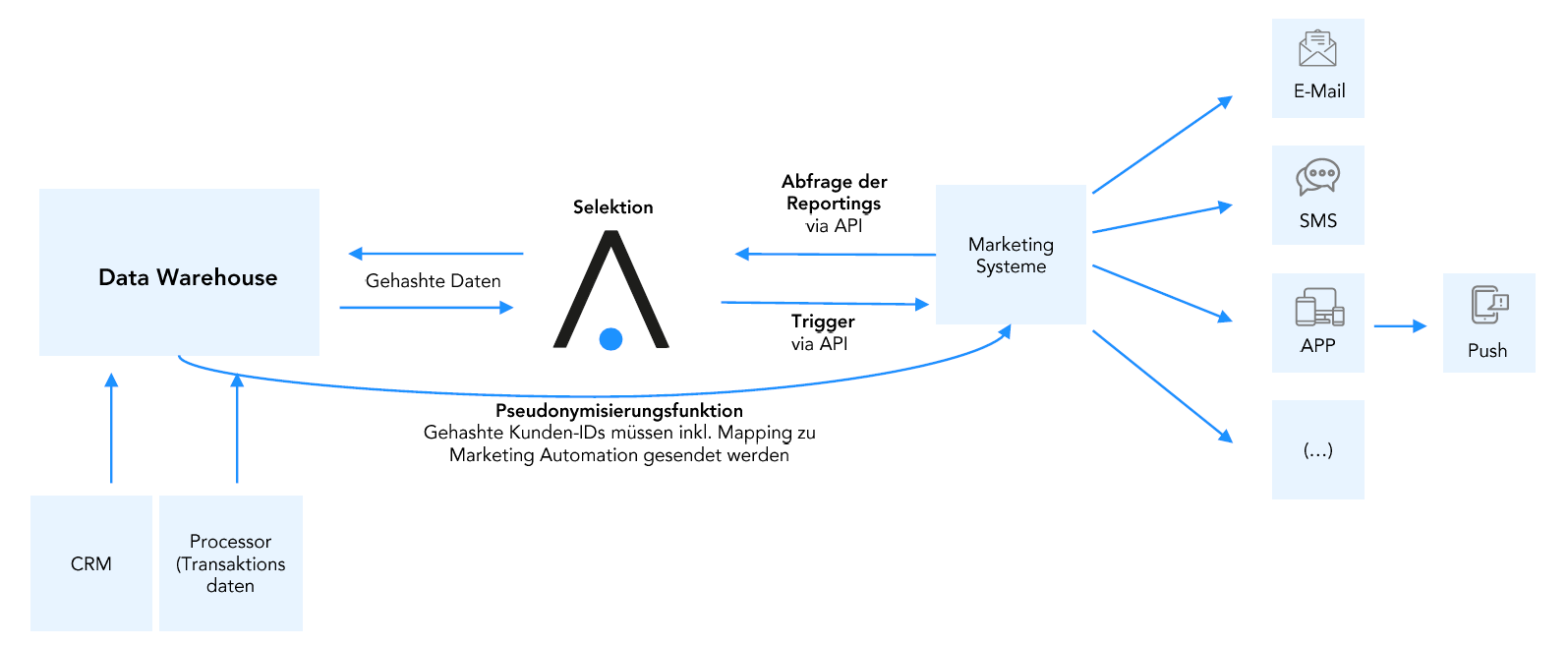

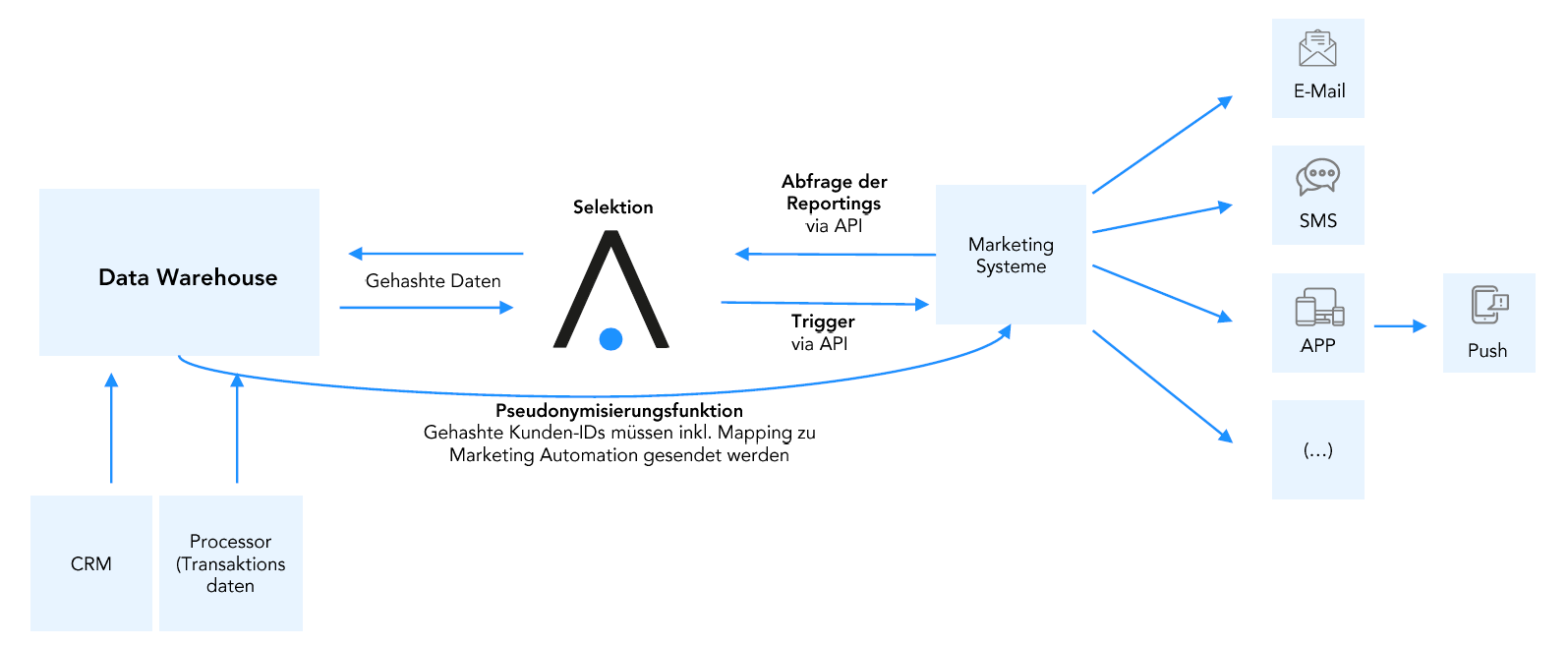

“A good advertisement is one which sells the product without drawing attention to itself.” – David Ogilvy Market Overview: The volume of customer data in banking and finance is exploding, while marketing and CRM teams are still stuck with outdated, clunky tools. Email marketing, performance campaigns, and personalized CRM journeys suffer from too much manual

⁉️The Myth of the Bad Chatbot "Our chatbot annoys more than it helps."This sentence is often heard in customer service—and with good reason. Many first-generation chatbots have disappointed: rigid decision trees, no context processing, zero understanding of customer intent. The result? Frustration on both sides. But that has changed. Modern AI assistants play in a

Introduction In a market where customer loyalty and profitability are key, it’s not just about maximizing short-term spending. The crucial question is: How travel-oriented is a customer – and how can that be monetized? The Travel Affinity Score provides a data-driven answer. It measures the degree of travel-related activity based on geo-referenced transactions and enables

Einleitung Im Wettbewerb um loyale und profitable Kunden reicht es nicht, kurzfristige Umsätze zu maximieren. Entscheidend ist die Frage: Wie viel ist ein Kunde wirklich wert – heute, morgen und übermorgen? Der Customer Lifetime Value (CLV) liefert darauf die Antwort. Er berechnet den langfristigen Ertrag eines Kunden – und gibt Kreditkartenanbietern die Möglichkeit, Budgetallokation, Kommunikation